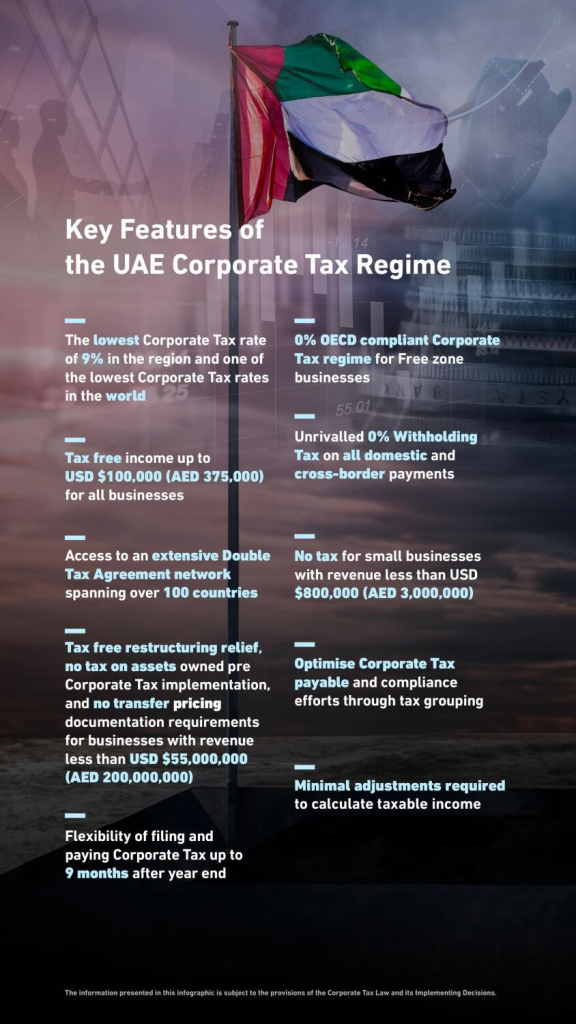

The UAE Corporate Tax regime, represents one of the most attractive tax regimes for local and global businesses looking to grow and expand with just a 9% headline tax rate. The regime complements the existing ease of doing business environment that the UAE has, as it has been carefully designed to incorporate best international practice and offers unrivalled benefits for businesses operating in the country when compared to many other jurisdictions. Specific key features of the regime are as follows….

The UAE Free Zone Corporate Tax regime offers a zero percent taxation rate for qualifying businesses. As a OECD compliant regime with over 80 free zones in the UAE, it not only provides certainty to investors but also offers an unrivalled and vast trading environment where a 0% Corporate Tax rate can be enjoyed on Free Zone to Free Zone transactions and other transactions with mainland and international customers that are considered Qualifying Activities. Specific key features of the regime are as follows….

The UAE Free Zone Corporate Tax regime for Designated Zones offers a zero percent taxation rate for qualifying businesses, including distribution businesses. As a OECD compliant regime with multiple designated free zones in the UAE, it not only provides certainty to investors but also offers an unrivalled and vast trading environment where a 0% Corporate Tax rate can be enjoyed on Free Zone to Free Zone transactions and other transactions with mainland and international customers that are considered Qualifying Activities. Specifically in a designated zone, distribution businesses can benefit from a 0% Corporate Tax rate even when transacting with mainland or international customers. Specific key features of the regime are as follows….

+ There are no comments

Add yours