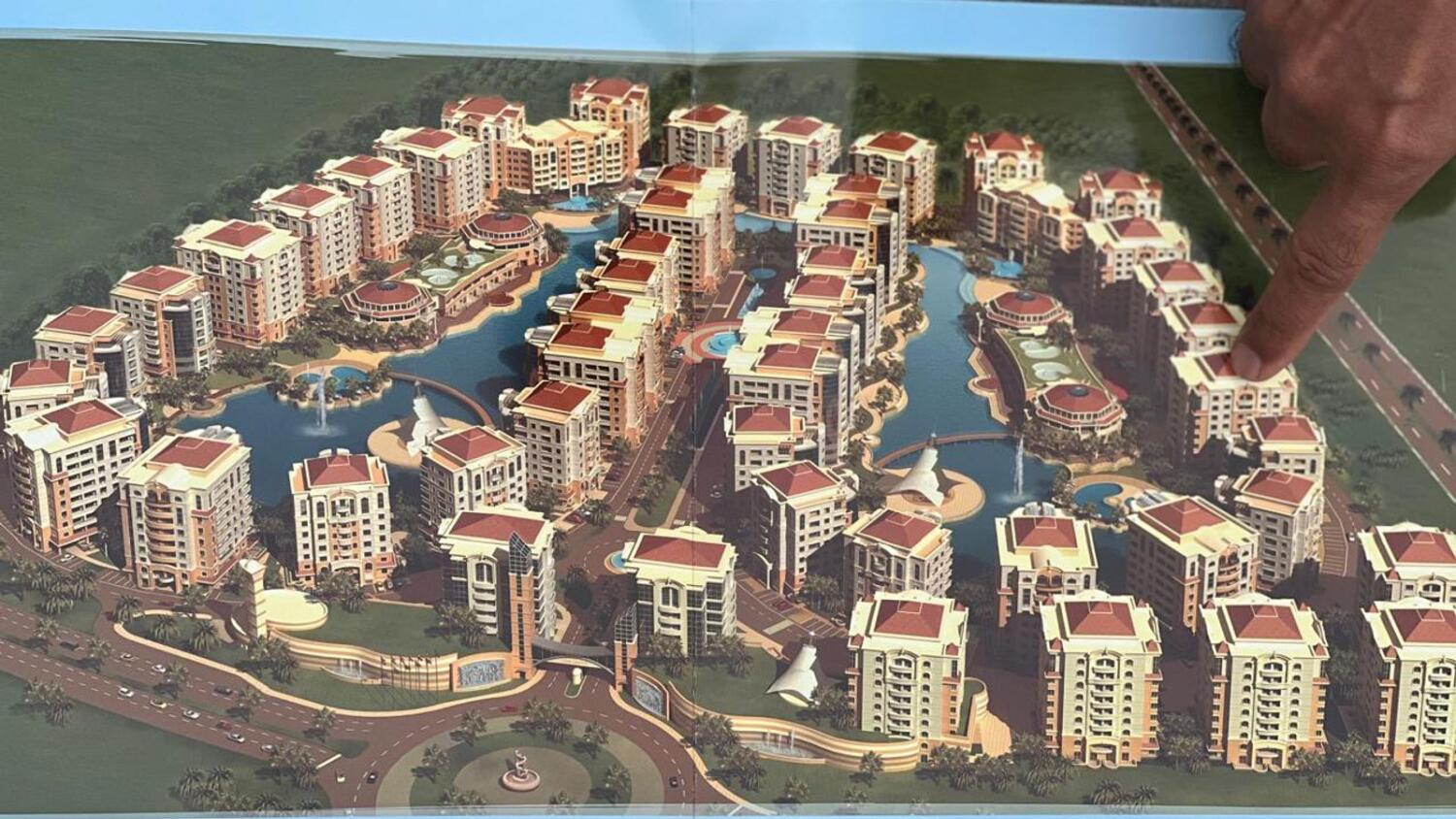

For almost many years, masses of property buyers within the Dubai Lagoon venture had been waiting in vain for his or her dream homes. Launched in 2005, the Dubai Lagoon, positioned in Dubai Investments Park (DIP), became purported to be a mixed-use improvement presenting 53 mid-rise homes with over 4,100 residential units. However, because of ongoing delays, monetary problems, and a series of unresolved disputes, the undertaking has now been marked as “beneath cancellation” by using the Dubai Land Department (DLD), leaving many buyers fearing the lack of their investments.

A Long-Awaited Dream Turned into Despair

Bibhu, a Dubai resident, was some of the first to invest in the Lily Zone of the Dubai Lagoon in 2007. He paid a substantial sum for a one-bedroom apartment, hoping to eventually call it home after years of anticipation. However, as production stalled and the challenge did not meet its unique deadlines, Bibhu, like many other buyers, located himself caught in an infinite ready game with out a clean solutions from the builders or government.

For years, the project’s developers, Schon Properties, made bold promises, inclusive of guaranteed finishing touch dates and economic consequences for delays. However, the primary section of the assignment became behind schedule more than one times, and through 2017, the duty for completing the project changed into transferred to Xanadu Real Estate Development. Despite reassurances from Xanadu, together with guarantees to complete the task within to three years, the development has remained in large part incomplete, with some buildings uncovered to the factors for greater than a decade.

Financial Strain and Uncertainty

The lack of development has left buyers like Heather Copland, a British investor who bought a one-bed room condominium in 2007, feeling deeply frustrated. She paid almost Dh600,000 for her unit, but after the switch of the mission to Xanadu, construction persisted to stall. Copland, who had paid the overall stability of her payment plan and other associated costs, is now uncertain whether or not her money will ever be again. She expressed issues that the homes, that have been left unfinished for see you later, may additionally not be financially possible, in addition complicating any ability restoration of her funding.

Another investor, Bibhu, referred to that despite the fact that a few buildings like D20 in the Lily Zone were in part finished, Xanadu’s claims of a loss of get admission to roads delaying the handover appeared unconvincing. The recent replace to the Dubai Rest app, which listed the undertaking as “beneath cancellation,” only deepened the uncertainty for Bibhu and different buyers, lots of whom have paid as much as 75% of the full rate of their units.

The Refund Dilemma

As the assignment’s repute became more doubtful, some buyers, like Hani Gandhi, who purchased his condominium in 2015, began pursuing refund options. However, with the mission now officially “underneath cancellation,” investors are stuck in a difficult situation. According to a DLD call middle consultant, the refund process can only continue if the task’s fame is completely resolved, either by way of moving it to another developer or issuing refunds. Unfortunately, if the challenge stays “below cancellation,” the manner can’t flow ahead, leaving buyers in prison limbo.

For many buyers, like Omran Ali Juma, a 30-year-antique Emirati, the revel in has left a lasting sense of regret. Juma, who bought a studio condo in 2018 and paid in complete, is deeply disheartened by way of the dearth of clarity from authorities. Despite several visits to the DLD, Juma has determined no decision, and with out a development made in over 17 years, he has little hope that the scenario will enhance.

A Growing Call for Accountability

As the situation keeps to go to pot, traders are demanding accountability from the builders and authorities. Many experience that they have been bought guarantees that have never materialized, leaving them in financial distress. Ahmed Haashi, a 61-year-vintage investor from Zambia, shared his frustration after making an investment Dh750,000 in a -bedroom apartment. Despite a couple of visits to Dubai and common observe-ups, his investment remains in limbo, with little desire of a decision.

For buyers like Haashi, who funded his purchase with non-public financial savings and loans from pals and own family, the uncertainty surrounding the task has triggered no longer most effective financial difficulty however additionally emotional misery. “This revel in has shattered our hopes,” Haashi lamented. “We have been left out and left with out a solutions.”

The Road Ahead

The situation with the Dubai Lagoon venture increases vital questions about the responsibility of developers and the effectiveness of regulatory oversight within the UAE’s real estate region. As the DLD and Xanadu Real Estate Development remain silent on the problem, affected traders are left thinking who will take duty for the lost investments and what criminal recourse they have.

As many traders inside the Dubai Lagoon assignment now look for solutions, they also are searching for justice for the money they’ve spent over time. Some have began the lengthy process of pursuing refunds, while others are left wondering whether or not they will ever see a return on their investment.

The fate of the Dubai Lagoon mission serves as a cautionary story approximately the importance of transparency, well timed transport, and strong regulatory frameworks to defend buyers in the UAE’s booming real estate marketplace. Until the builders and government take decisive action, the future of loads of buyers remains uncertain, as they keep to fight for a decision to a crisis that has spanned almost two many years.

+ There are no comments

Add yours